Introduction:

In the dynamic world of technology and finance, staying informed about market trends and investment opportunities is crucial. One platform that excels in providing such insights is Fintechzoom.

This article delves into Fintechzoom’s role in stock market analysis, explores the transformation of Facebook to Meta Platforms, and offers a comprehensive guide to understanding and investing in Facebook stock.

What is Fintechzoom?

Fintechzoom is a leading financial news and analysis platform that covers a broad spectrum of topics, including stocks, cryptocurrencies, fintech innovations, and market trends. It provides investors with up-to-date information, expert opinions, and in-depth analyses to help them make informed investment decisions.

With a user-friendly interface and comprehensive coverage, Fintechzoom is an essential tool for both novice and experienced investors looking to navigate the complexities of the financial markets.

The Evolution of Facebook to Meta Platforms:

In October 2021, Facebook Inc. announced its rebranding to Meta Platforms Inc. This change reflects the company’s shift towards building the metaverse, a virtual reality space where users can interact with a computer-generated environment and other users.

This strategic pivot aims to expand beyond social media and explore new technological frontiers. The rebranding to Meta symbolizes a broader vision encompassing augmented reality (AR), virtual reality (VR), and other emerging technologies, positioning the company at the forefront of the next generation of digital interaction.

Read Also: Kecveto – Discover the Power of this Organic Superfood Blend!

Understanding Facebook Stock:

Facebook stock, now traded under Meta Platforms Inc. (NASDAQ: META), has been a significant player in the tech stock market. Understanding its stock involves analyzing the company’s performance, growth prospects, and market position within the tech industry.

Investors should consider factors such as historical stock performance, market capitalization, and the company’s strategic initiatives. Meta’s commitment to innovation and its strong financial performance make it a compelling investment option for those looking to invest in tech stocks.

Why Invest in Facebook Stock?

Investing in Facebook stock offers potential benefits due to its robust revenue streams from advertising, its strong user base, and its ongoing investments in future technologies like virtual reality (VR) and augmented reality (AR). The company’s innovative vision and strategic acquisitions further enhance its growth potential.

Meta’s dominant position in social media, coupled with its ambitious plans for the metaverse, provides a unique growth opportunity. The company’s ability to adapt and innovate in a rapidly changing digital landscape makes it a valuable addition to any investment portfolio.

Read Also: Bblog.Uk – Ready to Dive In?

Analyzing Facebook’s Financial Health:

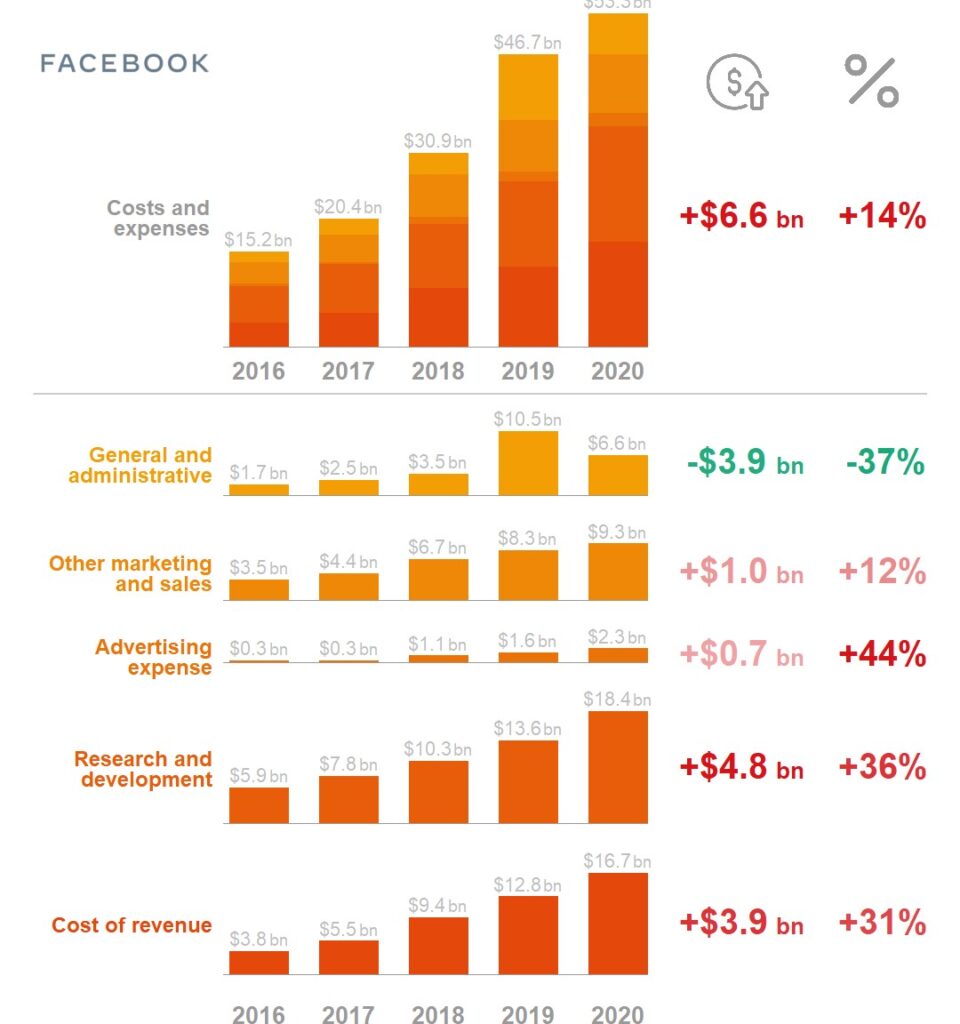

Meta Platforms has shown strong financial health, with consistent revenue growth and profitability. Key metrics to consider include revenue, net income, earnings per share (EPS), and cash flow. Analyzing quarterly and annual financial reports provides insights into the company’s financial stability and growth prospects.

The company’s diverse revenue streams, including advertising, hardware sales (such as Oculus VR headsets), and future potential in the metaverse, contribute to its financial resilience. Investors should also consider Meta’s investment in research and development, which underscores its commitment to maintaining a competitive edge through innovation.

Impact of Meta’s Rebranding on Stock Value:

Meta’s rebranding had a mixed impact on stock value initially, causing both excitement and skepticism in the market. While some investors see the metaverse as a lucrative future market, others are cautious about the significant investment required.

Monitoring how Meta’s strategic initiatives affect its stock over time is crucial. The rebranding represents a long-term strategic shift, and its full impact on stock value will unfold over the coming years. Investors should stay informed about the company’s progress in building the metaverse and its impact on revenue and profitability.

read Also: Errajy Ltd – The Ultimate Blueprint for Achieving Success!

Technological Innovations by Meta:

Meta Platforms is at the forefront of technological innovations, particularly in VR and AR. Products like Oculus VR headsets and Horizon Workrooms showcase Meta’s commitment to creating immersive virtual experiences. These innovations are expected to drive future growth and potentially boost stock value.

The company’s investments in AI, machine learning, and other cutting-edge technologies further enhance its position as a leader in tech innovation. Meta’s focus on building a connected digital ecosystem positions it well to capitalize on emerging trends in digital interaction and communication.

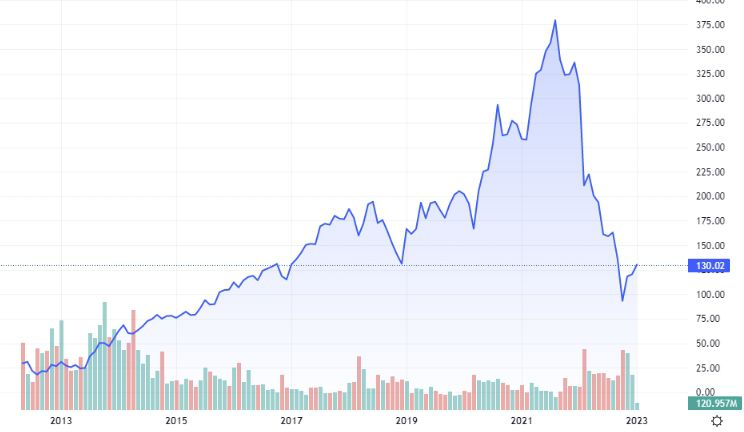

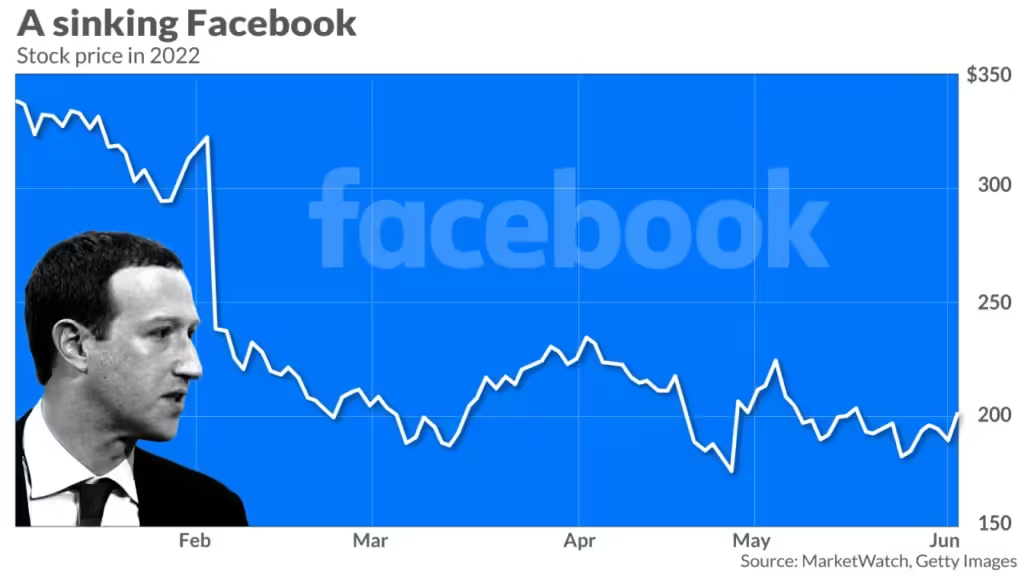

Facebook Stock Performance in 2023:

In 2023, Facebook stock showed resilience amid market volatility. Factors influencing its performance include quarterly earnings reports, user growth, ad revenue, and advancements in metaverse-related projects. Keeping track of these factors helps investors gauge the stock’s potential trajectory.

Meta’s ability to innovate and adapt to changing market conditions has helped it maintain strong stock performance. Investors should also consider broader market trends and economic factors that may impact tech stocks, such as changes in interest rates and regulatory developments.

Read Also: John Fogerty Net Worth – A Comprehensive Look at the Rock Legend!

Risks Associated with Investing in Facebook Stock:

Investing in Facebook stock carries risks such as regulatory scrutiny, privacy concerns, and competition from other tech giants. Additionally, the substantial investment in the metaverse poses financial risks if the market does not develop as anticipated. Being aware of these risks is essential for informed investment decisions.

Investors should also consider potential risks related to data security and user privacy, which have been areas of concern for social media platforms. Diversifying investments and staying informed about regulatory changes and industry trends can help mitigate these risks.

Expert Opinions on Facebook Stock:

Financial experts and analysts often provide varied opinions on Facebook stock. Some highlight its long-term growth potential due to technological innovations, while others point out the risks associated with regulatory challenges and market competition. Consulting multiple expert opinions can offer a balanced perspective.

Analysts often provide insights based on detailed financial models and market analysis, which can help investors make more informed decisions. Following expert opinions and market analysis on platforms like Fintechzoom can provide valuable guidance for investors.

Read Akso: SuicideBoys Net Worth – A Complete Overview!

How to Invest in Facebook Stock:

Investing in Facebook stock involves setting up a brokerage account, conducting thorough research, and deciding on the amount to invest. It’s important to diversify your portfolio to mitigate risks. Regularly reviewing your investment and staying updated with company news can help in making informed decisions.

Investors should also consider setting investment goals and risk tolerance levels to guide their investment strategy. Using tools and resources available on platforms like Fintechzoom can provide valuable insights and help investors track their investments and make adjustments as needed.

Comparing Facebook with Other Tech Giants:

Comparing Facebook with other tech giants like Google (Alphabet), Apple, and Amazon provides insights into its competitive position. Factors to consider include market capitalization, revenue growth, innovation, and market share.

Such comparisons help investors understand the relative strengths and weaknesses of their investments. Meta’s focus on the metaverse and its existing dominance in social media distinguish it from other tech giants. Investors should consider how Meta’s strategic initiatives compare with those of other leading tech companies and the potential impact on long-term growth and profitability.

Read Also: Nic Kerdiles Net Worth – A Comprehensive Overview!

The Role of Fintechzoom in Stock Market Analysis:

Fintechzoom plays a crucial role in stock market analysis by providing timely news, detailed reports, and expert opinions. Its comprehensive coverage helps investors stay informed about market trends, company performances, and investment opportunities.

Utilizing Fintechzoom’s resources can enhance your investment strategy. The platform’s user-friendly interface and in-depth analyses make it a valuable tool for both novice and experienced investors. Fintechzoom’s focus on fintech and digital innovation provides unique insights into emerging market trends and investment opportunities.

Conclusion

Investing in Facebook stock presents unique opportunities and challenges. Meta Platforms’ focus on technological innovation and the metaverse makes it an attractive option for tech-savvy investors. Leveraging resources like Fintechzoom can help investors stay informed, make strategic decisions, and navigate the complexities of the stock market with confidence.

Read Also: